Michigan’s Proposed Cannabis Tax Hike

- Magic Plants

- February 13, 2025

- No Comments

What Whitmer’s Changes Could Spell for Consumers, Growers, and Federal Tax Policy

Michigan’s cannabis industry is facing a new challenge—Governor Gretchen Whitmer’s proposed 32% wholesale tax on adult-use cannabis products.

If approved, this tax would significantly raise the cost of cannabis for consumers and put added pressure on growers. Meanwhile, the federal government quietly continues to profit through Section 280E, which strips cannabis businesses of key tax deductions.

Taken together, these changes could create a perfect storm for Michigan’s cannabis market. Here’s what you need to know.

Sponsored Content

Current Tax Situation

Michigan’s adult-use cannabis market is currently taxed at two levels:

- 10% Excise Tax – Applied at the point of sale

- 6% Sales Tax – Standard state tax for goods and services

Total Tax Burden for Consumers: 16%

That’s already a manageable but noticeable portion of the price.

Under the proposed tax plan, however, a 32% wholesale tax would be added on top, bringing the total tax burden to 48% or more by the time a product reaches the consumer.

How the New Tax Will Affect Consumers

If this tax is implemented, consumers will see higher prices at dispensaries. Here’s a quick example:

- Current average price of an ounce: $70

- Projected price with new tax: $91.34

For some consumers, these price hikes will be a dealbreaker. The legal market, already competing with lower-priced black market products, could lose customers unwilling to pay nearly 50% in taxes. This shift back to the illicit market threatens to undo the public safety and regulatory benefits of legalization.

Impact on Growers: Squeezed from All Sides

For Michigan’s cannabis growers, the 32% wholesale tax poses a different set of challenges. Unlike retailers, who can adjust their prices, growers operate at the beginning of the supply chain, where options to pass on costs are limited.

1. Shrinking Profit Margins

Growers will be forced to sell their products at lower prices to processors and retailers, who will be trying to offset the wholesale tax. This will slash profit margins, especially for small and mid-sized growers who are already struggling with oversupply and falling wholesale prices.

2. Market Consolidation

Larger, vertically integrated companies with deeper pockets will have an easier time absorbing the added costs. This could lead to a wave of market consolidation, pushing small and craft growers out of the industry.

3. Slowing Growth and Investment

The uncertainty caused by the proposed tax may freeze investment in the state’s cannabis industry. Expansion plans, facility upgrades, and hiring could be delayed as growers brace for tighter margins.

4. Pivot to Medical Cannabis

Some growers may look to the medical cannabis market, which would be exempt from the new wholesale tax. Although smaller, this market may become a lifeline for growers seeking a more stable revenue stream.

The Federal Wild Card: 280E

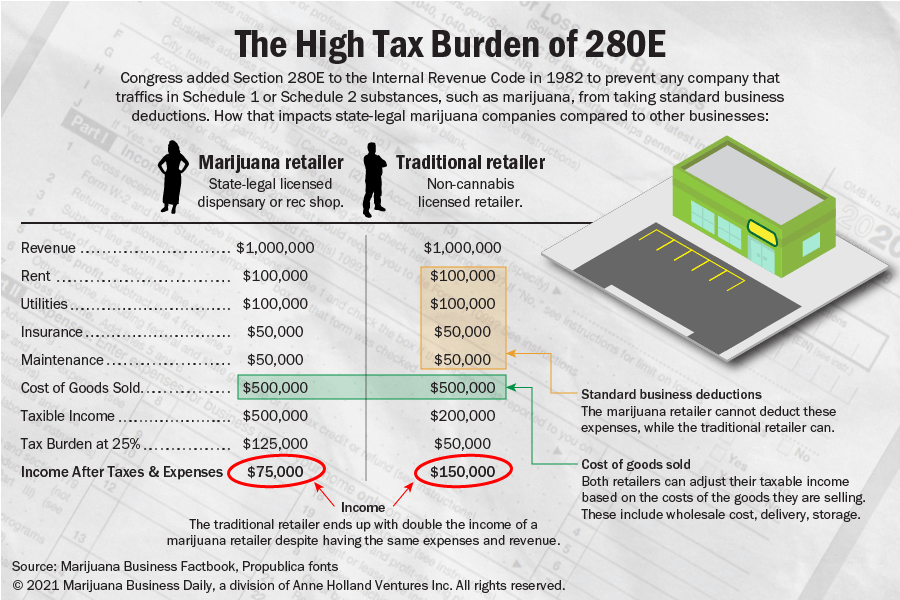

While Michigan growers and retailers face rising state taxes, the federal government continues to profit through Section 280E of the Internal Revenue Code. This decades-old policy prevents cannabis businesses from deducting standard business expenses—like payroll, rent, and marketing—because cannabis is still federally illegal.

How 280E Hurts Cannabis Businesses

- Cannabis companies are taxed on their gross revenue, not their net income.

- Even businesses operating at a loss may owe huge federal tax bills.

Is 280E Going Anywhere?

For now, the federal government seems content to keep 280E in place. It’s a significant source of federal tax revenue, and repealing it would require acknowledging cannabis as a legitimate industry—something Congress has been slow to do.

The Double Tax Squeeze

If Michigan’s 32% wholesale tax becomes law, cannabis businesses will face a double tax squeeze:

- Higher state taxes on every sale

- Massive federal tax bills due to 280E

For small businesses, this could be an existential threat. Combined, these taxes would leave razor-thin margins—or none at all—forcing companies to either scale back or shut down entirely.

What’s Next?

The proposed tax plan is still under review and requires approval from the Michigan Legislature. This gives industry leaders and stakeholders a window of opportunity to advocate for a more balanced approach that protects both the state’s revenue goals and the long-term health of the cannabis market.

Conclusion: Finding Balance

The cannabis industry has always been resilient, but balancing the competing demands of state tax revenue, consumer affordability, and business viability is critical. If Michigan pushes too hard on taxation, it risks shrinking the very industry it seeks to profit from. At the same time, pressure is mounting at the federal level for a solution to 280E—a change that would provide much-needed relief for businesses struggling to survive in a highly taxed environment.

Michigan’s proposed 32% wholesale tax, combined with the ongoing burden of federal tax policy, could reshape the state’s cannabis industry in profound ways. Balancing state revenue goals with the economic health of growers, retailers, and consumers is critical. Without careful adjustments, we risk higher prices, more business closures, and a resurgence of the illicit market.

For Industry Stakeholders:

- Stay Informed: Track the progress of this tax proposal in the Michigan Legislature.

- Speak Up: Join industry associations or advocacy groups like the Michigan Cannabis Industry Association (MiCIA) to engage with lawmakers and shape future regulations.

- Collaborate: Work together to develop alternative tax structures that ensure both state revenue and industry survival.

For Consumers:

- Support Local Businesses: Buy from licensed retailers and stay engaged in how these policy changes affect your access and pricing.

- Make Your Voice Heard: Contact your state representatives to express your concerns about the proposed tax. Lawmakers listen to voters—let them know how this will affect you!

Together, we can ensure Michigan’s cannabis market stays vibrant, competitive, and accessible for everyone.